Chase (Pay) + PayPal Integration

Overview

Launched in 2015 as a QR code-based app, Chase Pay entered a rapidly evolving mobile payments market dominated by Apple, Google, and Samsung. To remain competitive, JPMorgan Chase aimed to expand its digital footprint and meet growing demand for seamless, secure, and widely accepted mobile payment options.

By 2017, the adoption of mobile wallets had accelerated significantly:

Over 50% of smartphone users in the United States had tried a mobile wallet, reflecting growing trust in digital payments.

Global mobile payment volume surpassed $700 billion, marking a 200% increase since 2014.

Consumers reported that speed, convenience, and integrated loyalty rewards were the top reasons for using mobile payment services.

In July 2017, Chase Pay announced its partnership with PayPal, enabling customers to link their Chase cards directly to their PayPal accounts. This partnership extended Chase’s reach to over 200 million active users and strengthened its position in the growing digital commerce market.

Role

Lead UX Designer

Stakeholders

Product Manager, Engineering, Content Strategist, Research, Accessibility, Risk and Security

Timeline

5 months

product feature launch date

Q4 2018

Platform

Desktop, Mobile (iOS, Android)

business goals

Drive measurable card usage growth by positioning Chase as a preferred payment method within PayPal, deepening engagement across ecosystems.

Advance strategic partnerships through a unified cross-brand experience that reinforces trust, expands card linking adoption, and increases transaction volume.

Reduce operational overhead by streamlining the linking flow, decreasing user drop-off, and minimizing support inquiries tied to setup or errors.

User Goals

Effortlessly link Chase Pay and PayPal accounts to unlock the full value of Chase Pay features, including faster checkout, automatic card updates, and access to rewards without manual setup.

Feel confident in the security and privacy of every transaction through tokenized payment information and transparent communication from trusted brands.

Seamlessly manage and redeem Chase Ultimate Rewards® points directly within PayPal checkout, making it simple to maximize benefits while maintaining control over payment preferences.

Impact

Following the 2018 redesign of the Chase Pay and PayPal integration, early adoption metrics and behavioral insights reflected measurable gains across engagement, trust, and transaction growth. Users responded positively to the simplified linking experience, automated updates, and ability to redeem rewards directly at checkout, all of which reinforced Chase’s presence within PayPal’s ecosystem.

68%

Users who linked their Chase Pay accounts through the new flow completed transactions more frequently within PayPal, signaling higher engagement and cross-platform usage.

+45%

Increase in Chase card transactions processed through PayPal, reflecting strong adoption of the integrated linking and payment experience.

72%

Of the surveyed users, those who expressed greater confidence in using Chase cards on PayPal cited automatic updates and tokenized security as key trust factors.

My role & scope

As the lead designer for the Chase Pay and PayPal integration, I was responsible for the end-to-end experience, from discovery and journey mapping to stakeholder alignment, delivery, and QA. I led the redesign of the PayPal integration, delivering a more intuitive, trustworthy, and frictionless linking experience that strengthened cross-brand trust and increased payment adoption across both platforms.

Discover: Partnered with the research team to plan and conduct user research sessions that uncovered pain points in the existing linking and checkout flows.

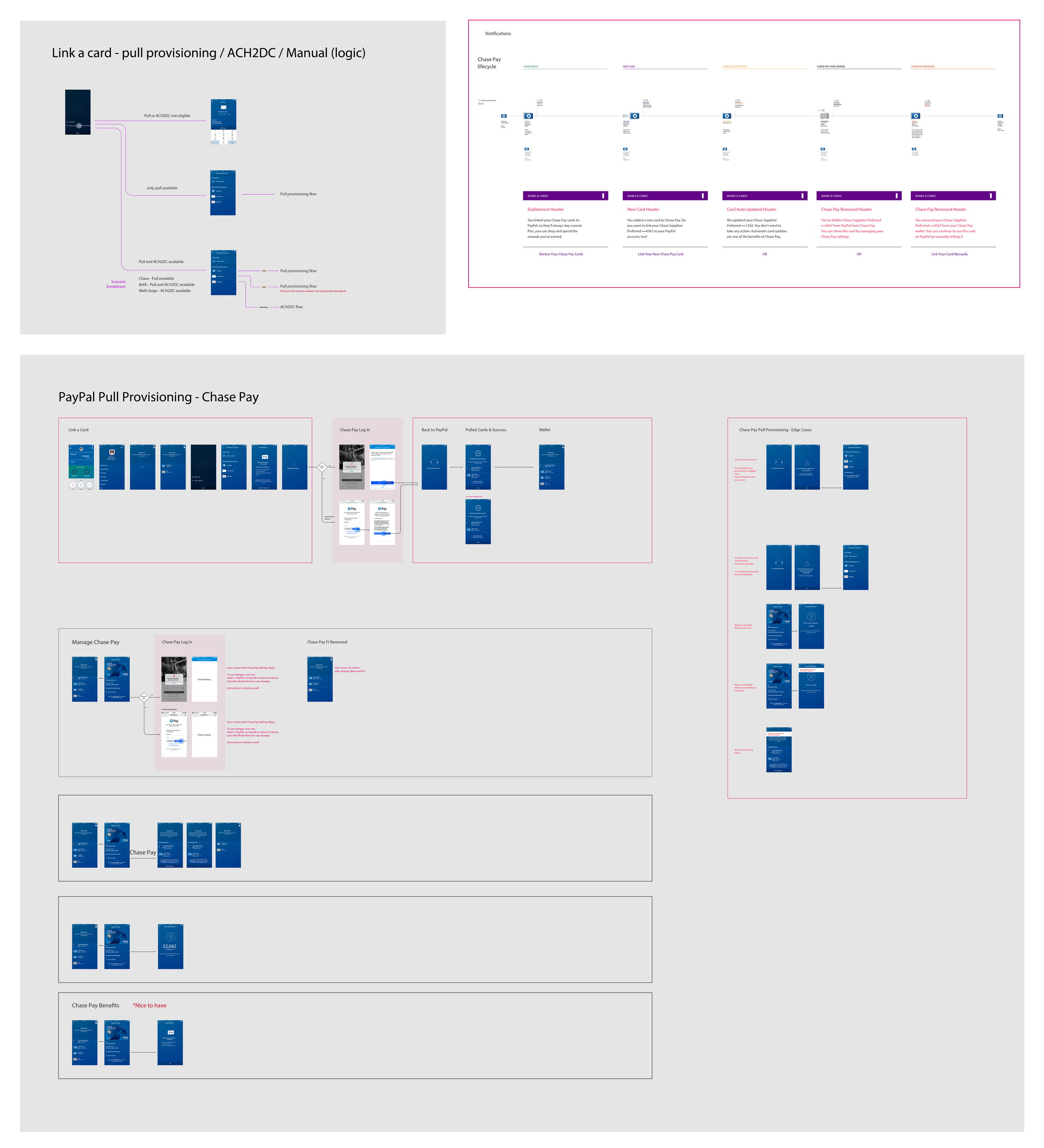

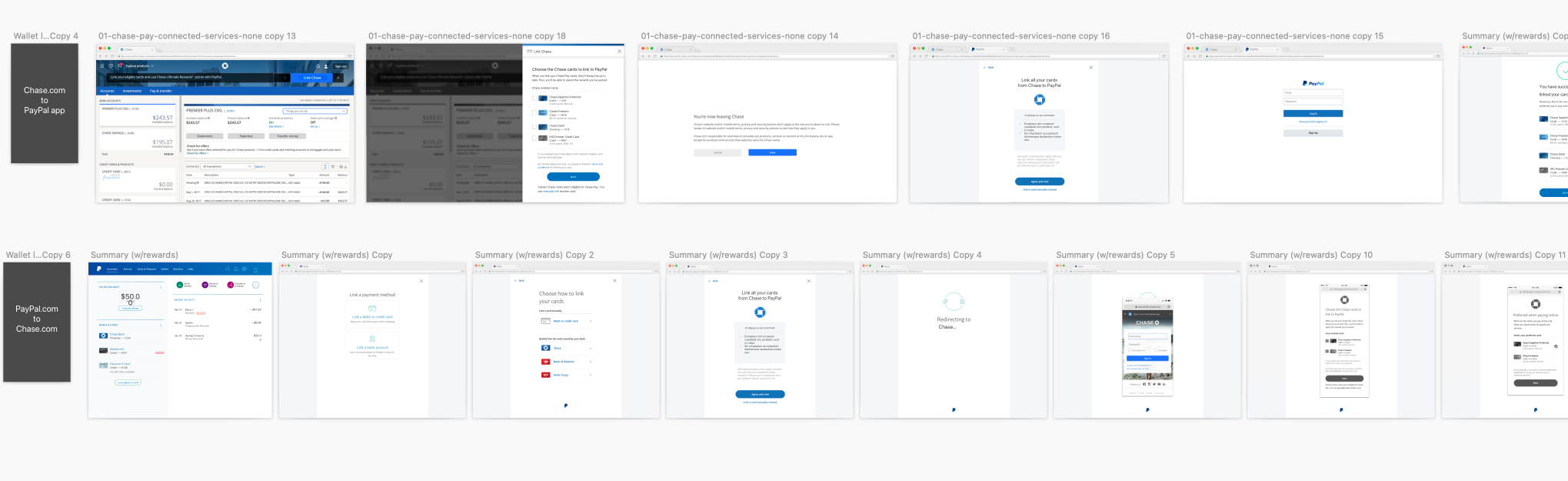

Define: Partnered with product managers, content strategists, and PayPal’s design team to outline key user scenarios, success metrics, and cross-platform considerations across Chase and PayPal ecosystems. Defined end-to-end user journeys for both entry points, linking from Chase and linking from PayPal.

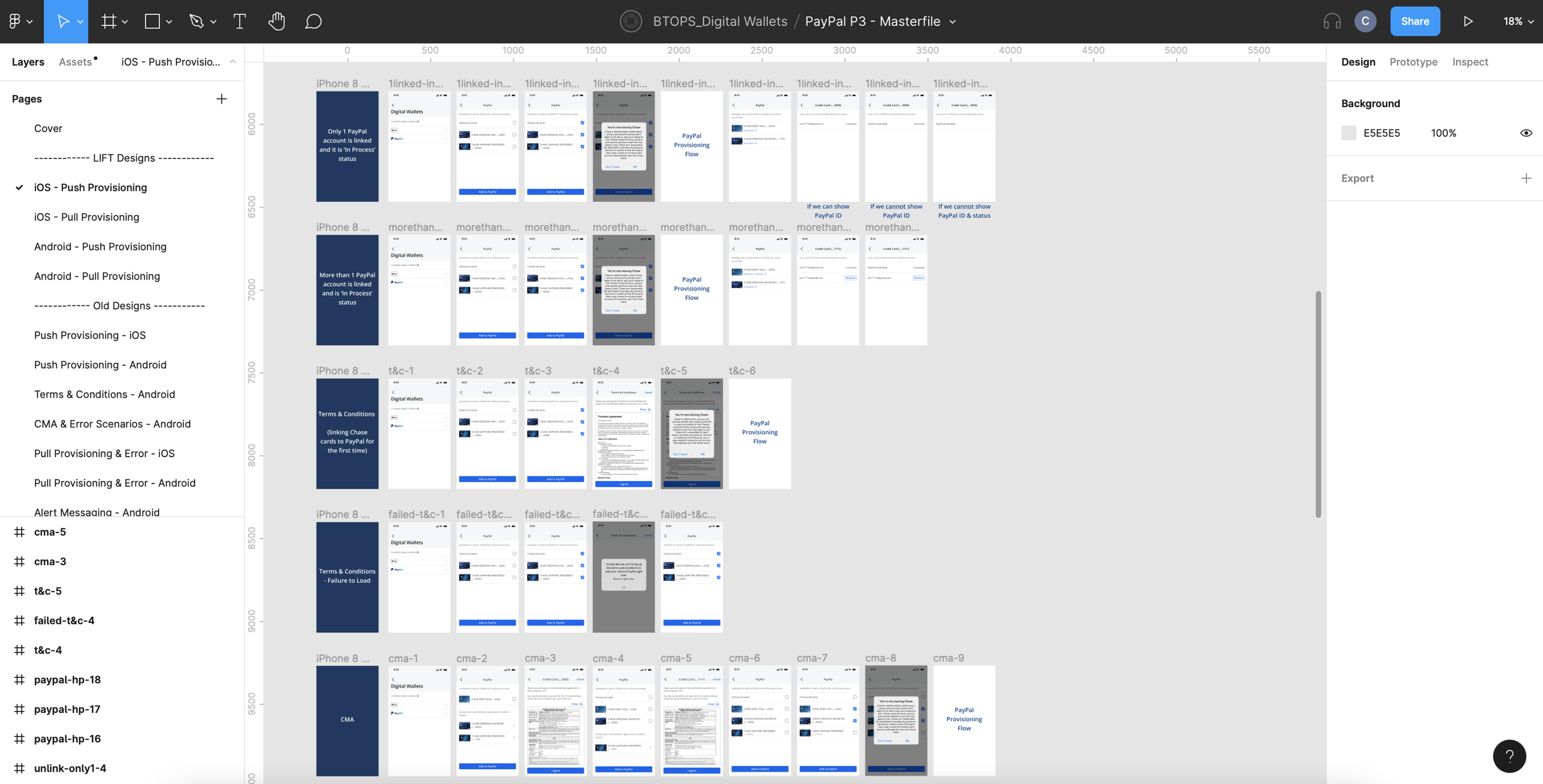

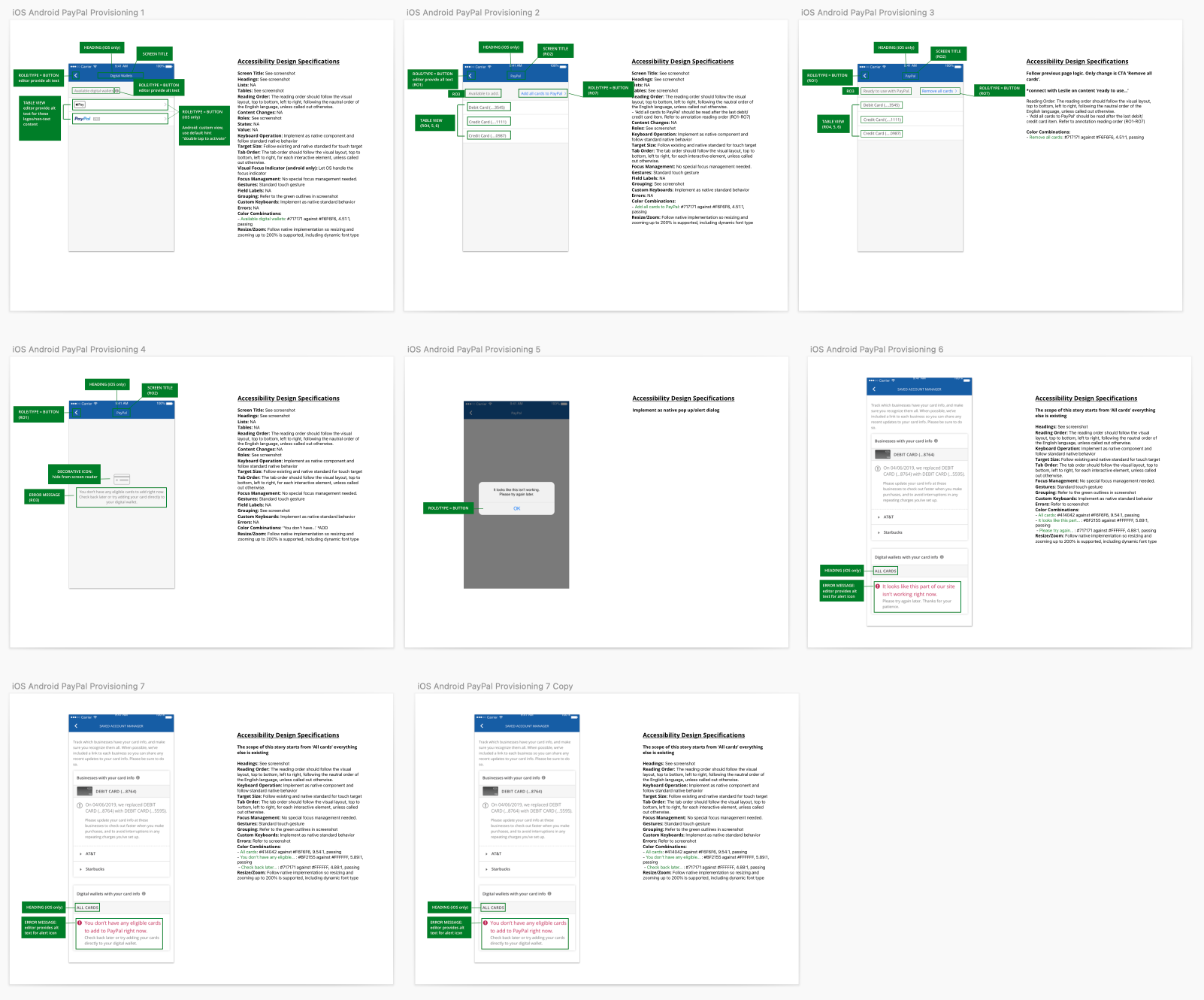

Design: Created detailed user flows and high-fidelity prototypes for linking, authentication, and redemption. Designed edge cases for expired or lost cards, tokenized payments, and automatic updates. Ensured all states met accessibility and brand consistency requirements for both organizations.

Validate: Conducted moderated usability testing with participants to evaluate comprehension, trust, and ease of completion across key flows and facilitated internal design reviews and stakeholder walkthroughs across Chase and PayPal teams to validate flow logic, terminology, and user comprehension. Incorporated feedback from business, content, and accessibility partners to refine the linking experience.

Iterate: Refined flows and visual treatments based on research findings and partner feedback to reduce cognitive load and improve task completion rates. Ensured messaging clarity across multiple entry points and updated states to reflect real-time card status and security notifications.

Collaborate: Worked closely with PayPal’s design, engineering, and product counterparts to align design patterns, ensure technical feasibility, and maintain consistency across brands. Partnered with Chase product, content, and legal teams to review compliance and experience parity.

Ship: Partnered with engineering and QA teams through build implementation to validate design fidelity and interaction accuracy, and defined success metrics to monitor linking completion, transaction lift, and redemption usage post-launch.

User & Context

PayPal users range from value seekers who maximize savings through coupons, loyalty programs, and rewards, to efficiency-minded shoppers who prioritize speed and simplicity. The Chase Pay and PayPal partnership was designed to serve both ends of this spectrum, enabling users to securely link their Chase cards in just a few taps, redeem rewards seamlessly at checkout, and complete purchases with confidence through a trusted, integrated payment experience.

Building on insights from the first design launch, our team analyzed previous research and user feedback to define three key personas that guided the 2018 redesign:

Pam, a rewards-focused shopper who values maximizing savings and redeeming points easily.

Bridget, a convenience-driven user who seeks a fast, frictionless checkout experience.

Paul, a security-conscious customer who prioritizes trust and data protection in every transaction.

These personas served as our guiding principle throughout the redesign, ensuring the experience met the diverse motivations and needs of our users.

User Journey

To identify opportunities for improvement within the PayPal ecosystem, I mapped the end-to-end user journey to uncover where and how Chase could enhance the PayPal experience. By outlining key scenarios such as linking cards and completing transactions, I identified moments of friction, overlap, and opportunity, allowing us to design targeted improvements that reinforced Chase’s value proposition within PayPal’s flow.

Research & Insights

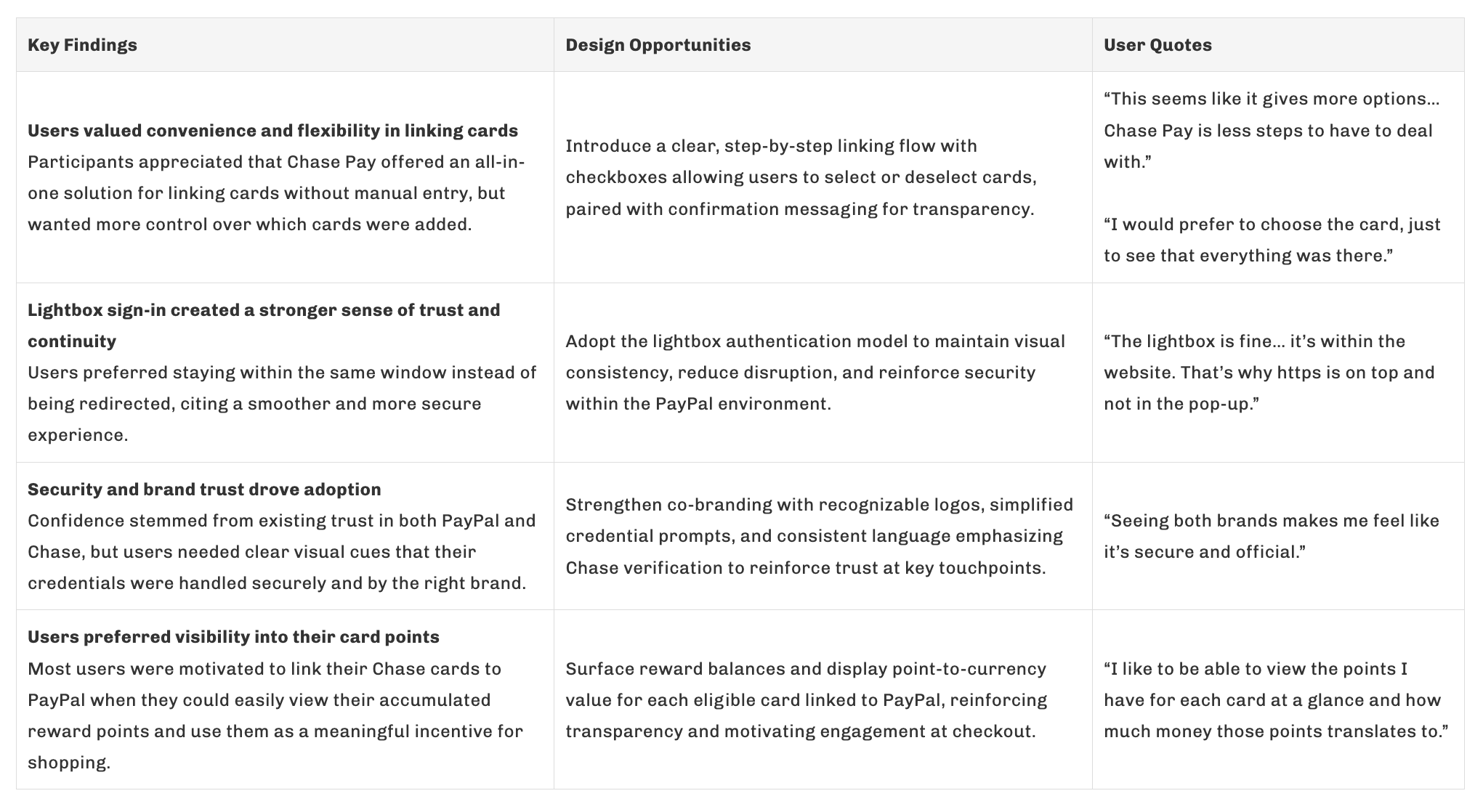

To guide the redesigned Chase Pay and PayPal integration, we built upon insights from prior usability sessions conducted in 2017, which helped shape and inform the focus areas for our next round of user research in 2018. This initial research utilized existing designs to gain a deeper understanding of users’ experiences, wants, needs, and pain points before proceeding with the redesign. Our goal was to uncover how customers perceived the linking experience, identify areas where confusion or friction occurred, and design a more seamless, trustworthy, and rewarding flow.

Through moderated interviews and prototype testing with the current designs, we observed 8 users across a spectrum of behaviors, from tech-savvy savers to cautious shoppers, and gathered actionable insights to refine both the end-to-end journey and interface design.

Together, these insights shaped the guiding principles for the redesign, strengthening user trust, increasing flexibility, and ensuring a cohesive experience across Chase Pay and PayPal. We also shared our findings with the PayPal design team to align on user needs, validate opportunities, and deliver a unified experience across both platforms.

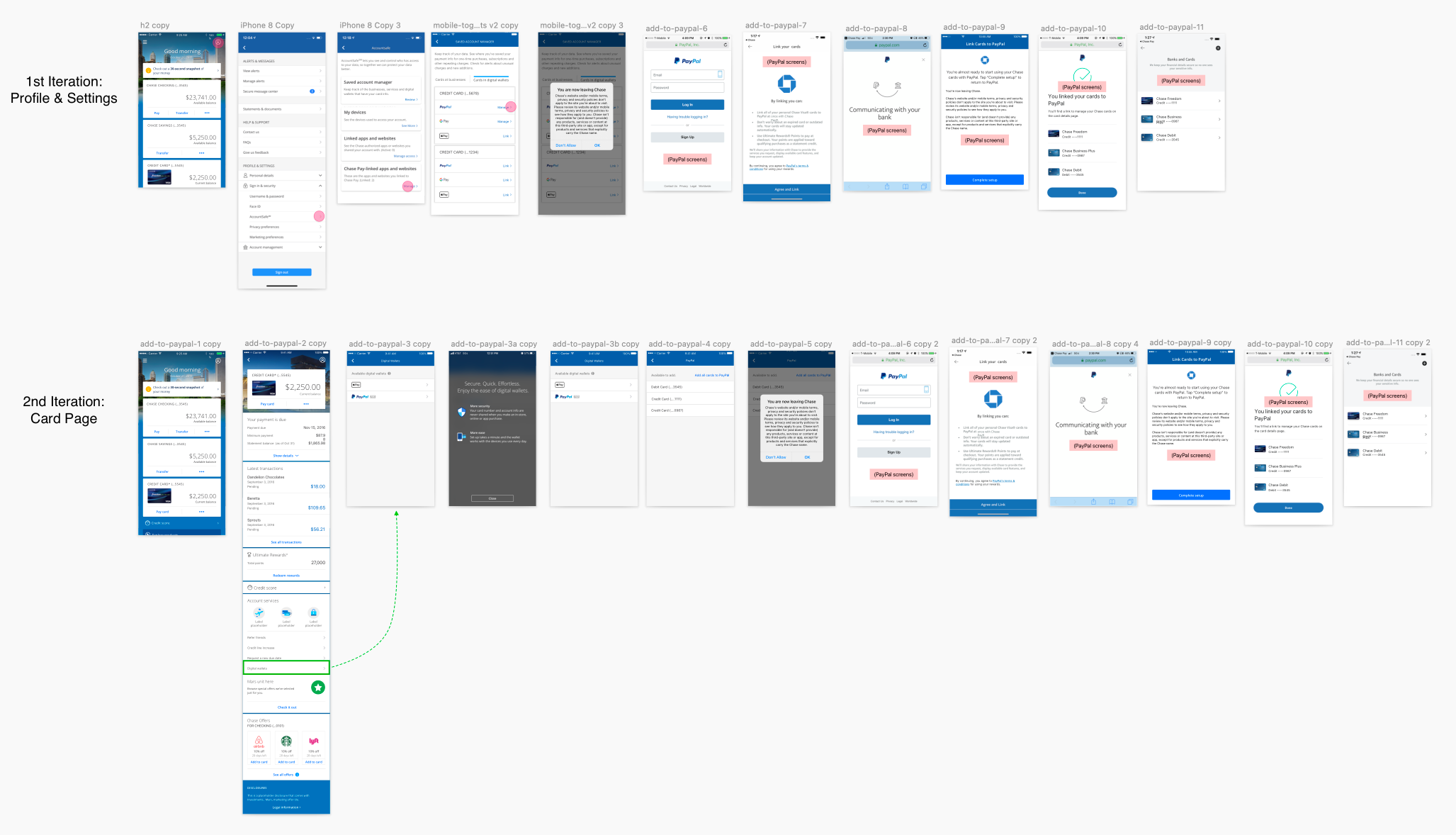

validation & Iteration

Based on the insights above, I iterated on a new set of designs and partnered with the research team to conduct a moderated usability test at our research lab with eight participants representing both new and existing Chase Pay users. Throughout this process, I collaborated closely with the PayPal design team, sharing each iteration so they were aware of the updates we proposed, aligned on design decisions, and could include them in their own testing. Each participant interacted with the prototype we created across web, iOS, Android, and Samsung experiences to evaluate comprehension, ease of navigation, and trust in linking their cards to PayPal.

In the current experience, users needed to navigate through several nested settings to add their cards. They first accessed Profile & Settings, then selected AccountSafe, clicked into Chase Pay-linked apps and websites, and only then viewed the list of eligible cards to add to PayPal. This multi-step journey introduced unnecessary friction and discoverability challenges.

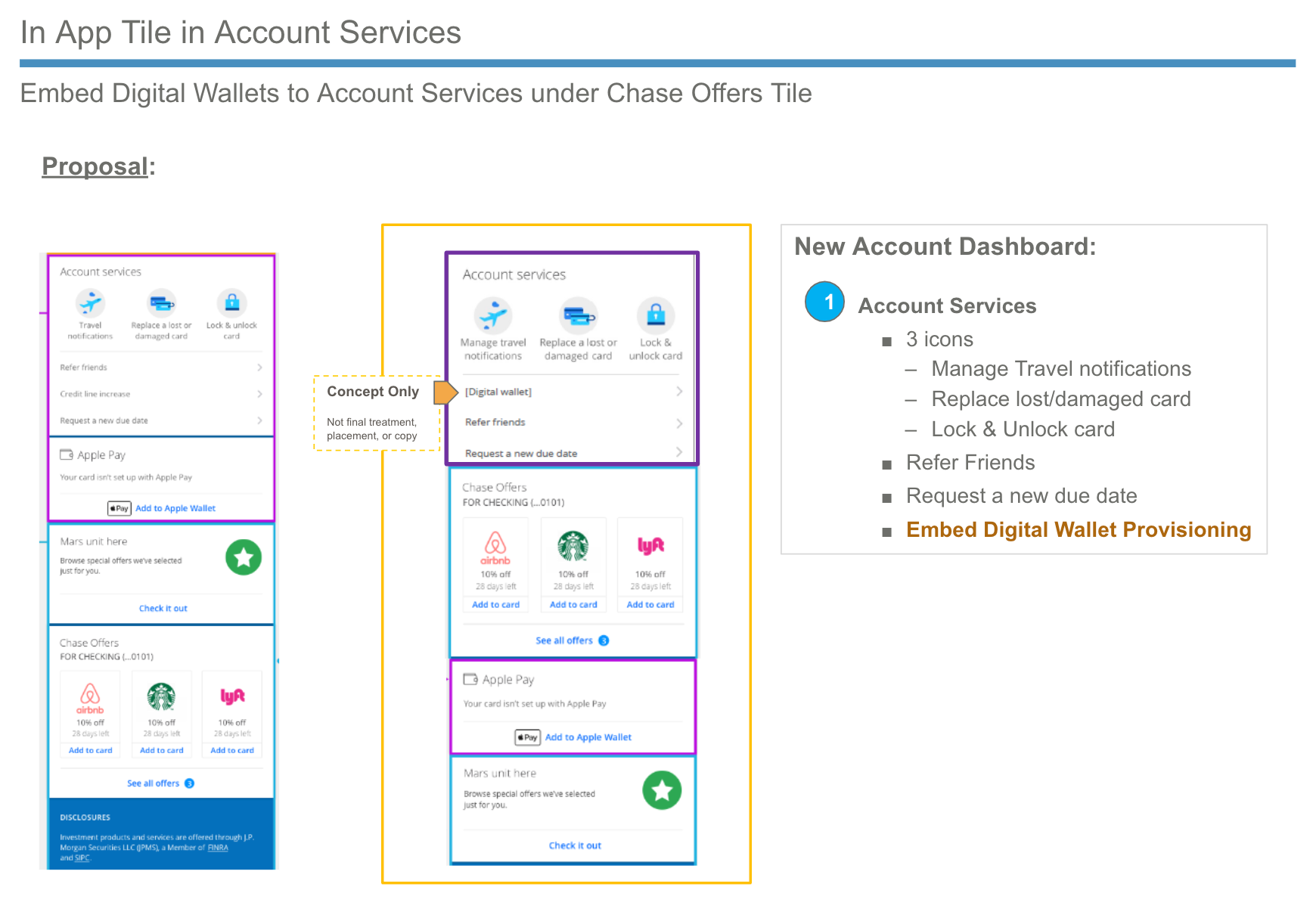

Midway through testing, I was also leading a parallel initiative to surface the Digital Wallets option directly on the homescreen. Once that feature was developed, I incorporated it into the prototype to create an updated user flow, enabling participants to access the wallet experience more intuitively.

Across sessions, users responded positively to the refined experience. The Digital Wallet entry point made it easier to discover where to link cards, while improved visual guidance and contextual rewards information supported confident decision-making.

Key Findings:

Most participants successfully located and completed the linking flow using the updated Digital Wallet entry point, citing improved visibility and fewer steps compared to the original settings-based path.

Participants expressed greater clarity and confidence when guided by contextual instructions within the flow, noting that the updated layout and copy made each step feel more straightforward and secure.

Users found it highly valuable to view accumulated rewards points beneath each eligible card, along with their cash equivalent, which helped them choose the card that offered the greatest benefit when linking to PayPal.

Several participants described the updated design as “simpler” and “more intuitive,” with fewer distractions and a clearer understanding of how Chase Pay integrates with PayPal for everyday use.

Final Designs & Delivery

As the project approached handoff, I partnered closely with cross-functional teams to ensure the final designs were fully aligned, accessible, and implementation-ready. Throughout iteration, I regularly shared updates with the PayPal design team to keep them informed of proposed changes and validate that our refinements aligned across both ecosystems. Every detail was reviewed to maintain accuracy, consistency, and compliance across Chase and PayPal platforms.

Aligned with stakeholders, product managers, engineers, and accessibility teams to review and finalize all design specifications before delivery.

Collaborated with the accessibility team to provide detailed annotations, ensuring all components met accessibility standards and WCAG compliance.

Worked closely with PayPal’s design team to annotate requested updates, document final changes, and test proposed refinements for cross-platform alignment.

Designed for a comprehensive set of 18 user flows per platform, covering iOS and Android, including both the happy path and all error and edge cases to ensure robust coverage and clarity across scenarios.

Reviewed design fidelity and implementation feasibility with engineering to confirm readiness for build and QA.

reflection & what’s next

Collaborating with an external partner, such as the PayPal design team, offered a valuable perspective on how large-scale organizations align across ecosystems. This project deepened my understanding of managing complexity, both in navigating multiple design systems and in coordinating seamless user journeys across brands. Mapping the experience early on also surfaced critical opportunities to simplify flows and strengthen the connection between Chase and PayPal.

Partnering with PayPal’s design team provided insight into their workflows, communication rhythms, and design principles, which strengthened cross-team collaboration and alignment across two organizations.

Working within two distinct design systems taught me how to merge patterns, visual languages, and accessibility standards to create a unified, user-centered experience.

Mapping the user journey at the outset was instrumental in identifying friction points early, allowing me to prioritize improvements that made the linking flow more intuitive and discoverable.

Visit Chase’s company site to learn more: Chase and PayPal