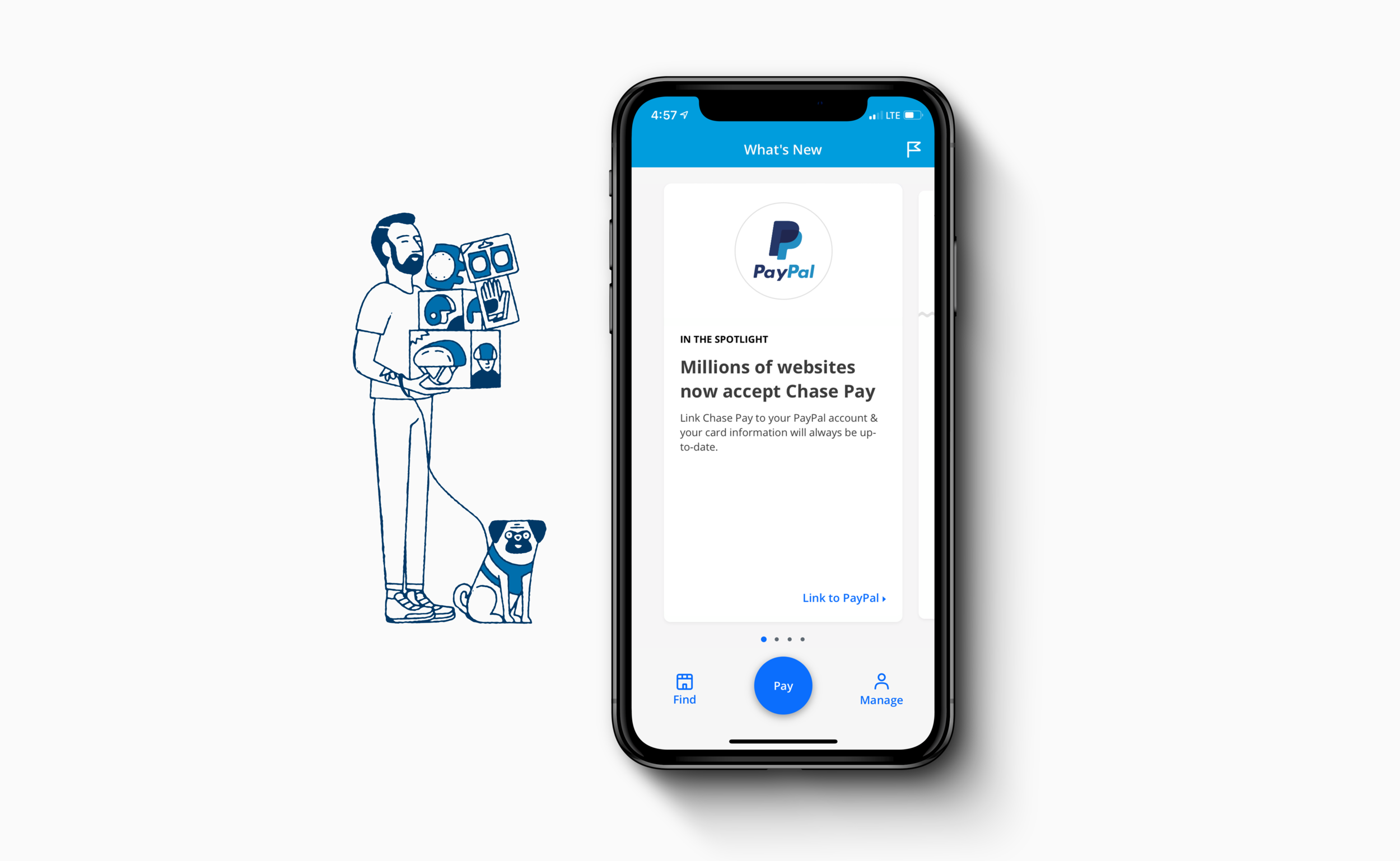

Seamless PayPal Integration for Chase

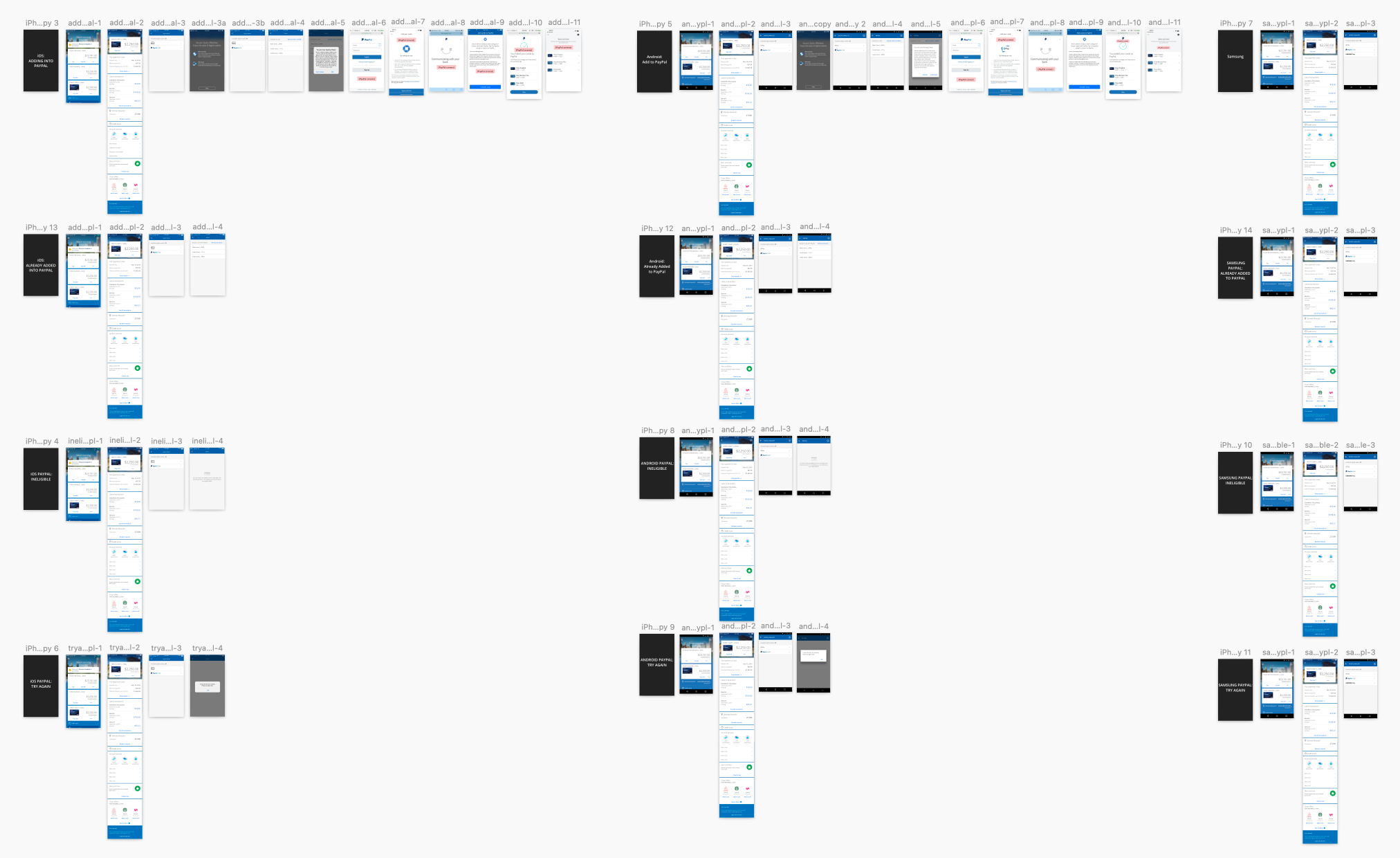

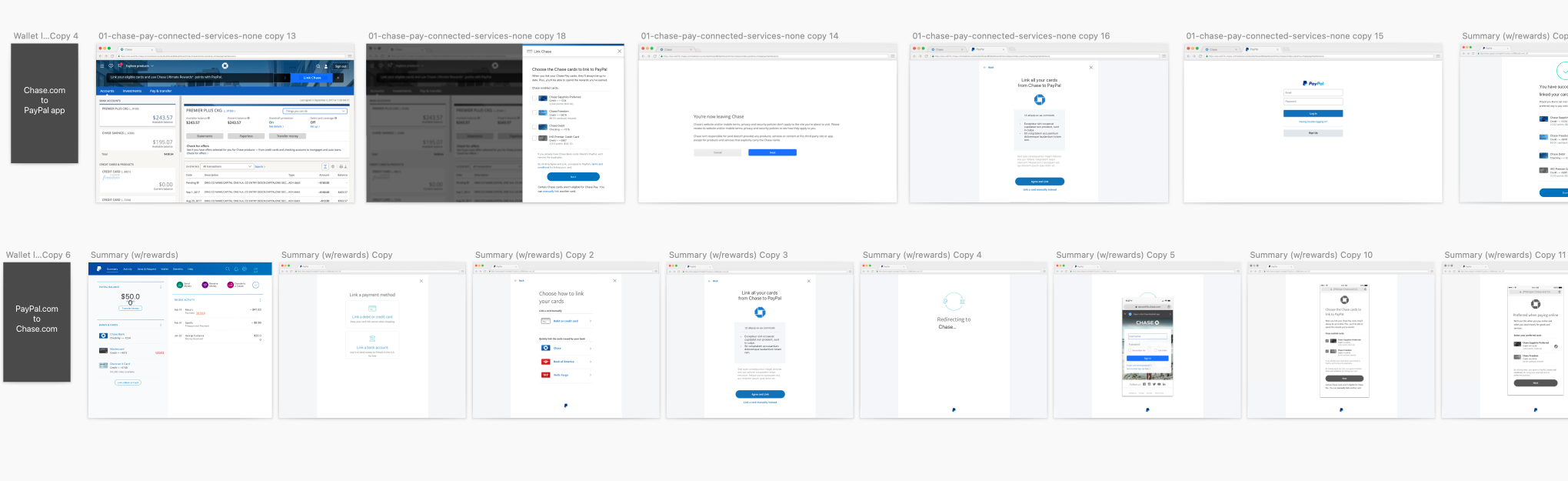

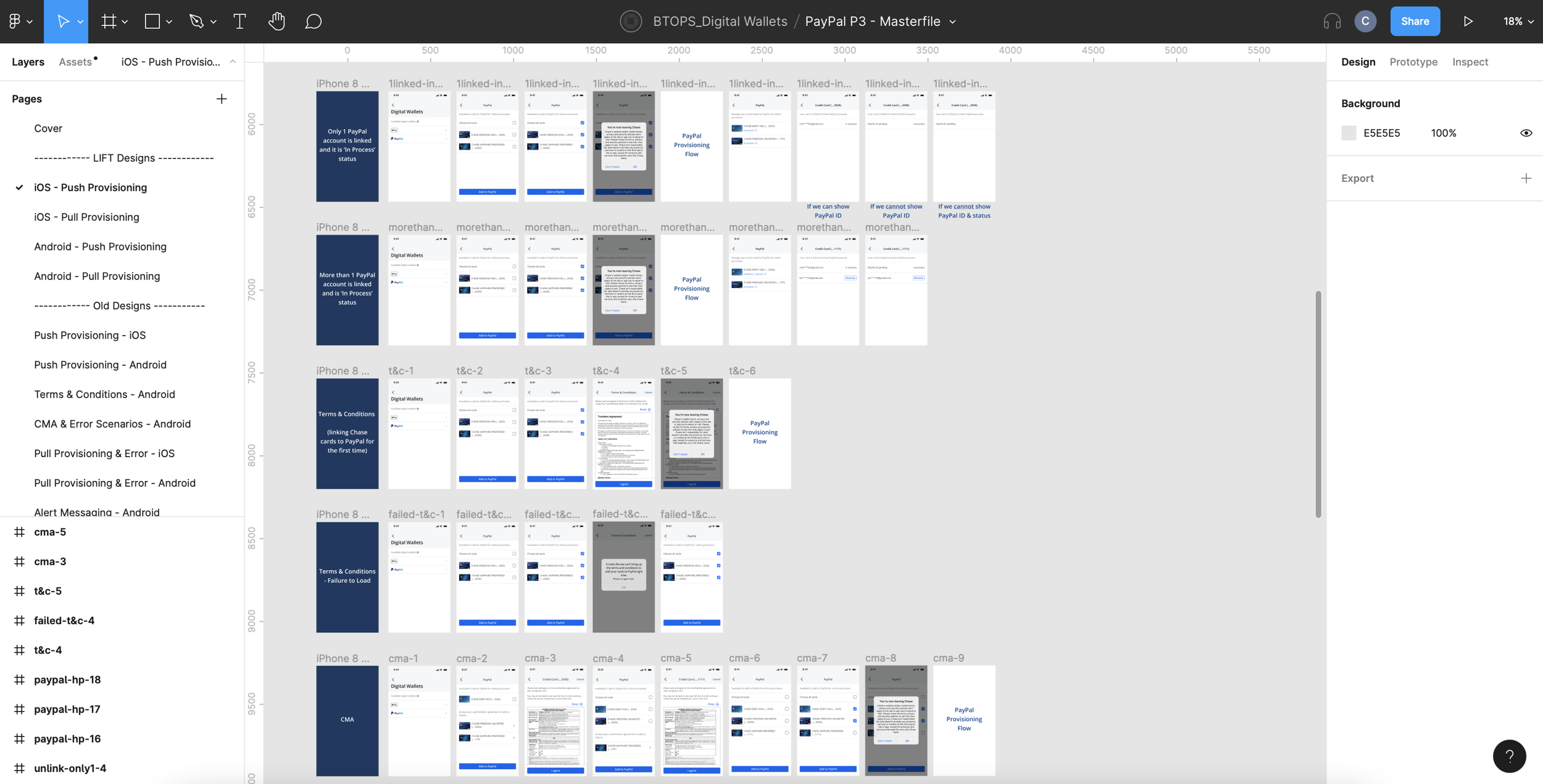

Consumer Payments Integration Platform • Launched Q4 2018Launched in 2015 as a QR code–based app, Chase Pay entered a mobile payments landscape that was quickly redefining what “easy” and “everyday” really meant. As customers gravitated toward faster, more widely accepted digital wallets, JPMorgan Chase reached a clear inflection point: evolve Chase Pay beyond a standalone experience or risk fading from daily commerce. By 2017, with mobile wallet adoption surpassing 50% of U.S. smartphone users, Chase partnered with PayPal to meet customers where they already paid, allowing Chase cards to be seamlessly linked to PayPal accounts and extending Chase’s reach to over 200 million active users. I led the end-to-end experience design, enabling customers to add their Chase cards from either the Chase or PayPal entry point, while partnering closely with PayPal designers to thoughtfully address edge cases and ensure a clear, reliable experience across every scenario.

Role: Lead Product Designer

Stakeholders: Product Owner, Engineering, Content Strategist, Research, Accessibility

Timeline: 5 months

Product Launch Date: Q4 2018

Platform: Desktop, Mobile (iOS & Android)

The Design Opportunity

This integration presented a clear opportunity to bring Chase closer to customers’ everyday payment flows by making it effortless to link Chase cards to PayPal, meeting users where they already pay, and expanding Chase’s digital reach. By designing a seamless experience across both entry points, we could reduce friction, reinforce trust in cross-brand payments, and position Chase as a preferred payment method within PayPal. Just as importantly, the integration enabled users to easily access and redeem rewards at checkout, helping them confidently choose the card that delivered the greatest value while driving deeper engagement across both ecosystems.

75%

Merchants worldwide accept PayPal, making it a clear opportunity for Chase to design a trusted, scalable integration into everyday payment flows

70%

Of consumers abandon transactions when their preferred payment method isn’t accepted, highlighting the value of seamless PayPal integration within Chase Pay

Meet The Users

PayPal users span a wide range of behaviors from value seekers who optimize savings through rewards and offers to efficiency-minded shoppers who prioritize speed and simplicity. The Chase Pay and PayPal partnership was designed to support both, enabling customers to securely link Chase cards in just a few taps and complete purchases with confidence through a trusted, integrated payment experience.

To ground the redesign in real user needs, I partnered closely with the PayPal design team, who shared research and insights from their existing user studies to help clarify who we were designing for. Based on this research, we aligned on three core personas that guided the design:

Pam - a rewards-focused shopper who values maximizing savings and redeeming points easily.

Bridget - a convenience-driven user who seeks a fast, frictionless checkout experience.

Paul - a security-conscious customer who prioritizes trust and data protection in every transaction.

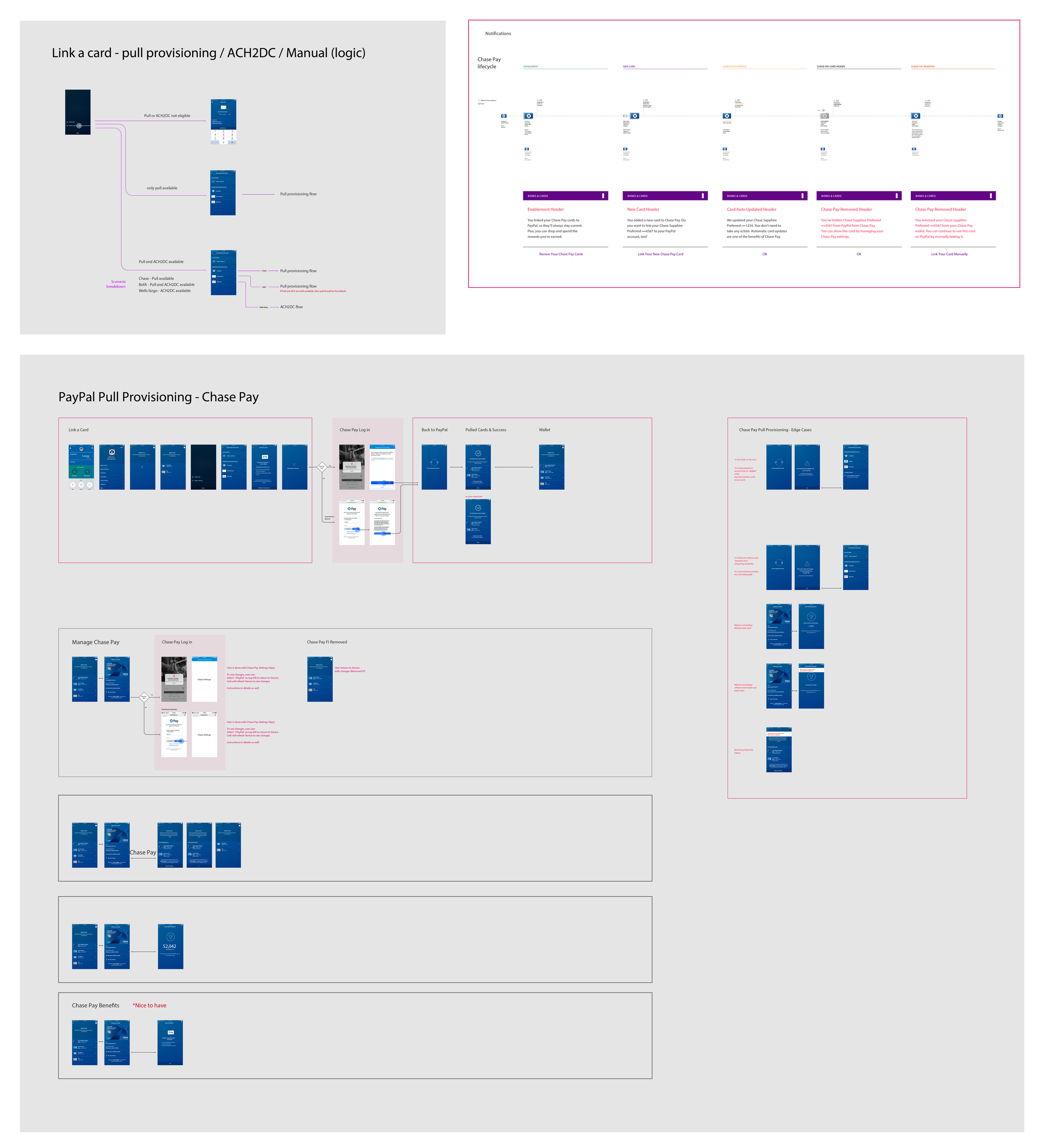

With a clear understanding of our users, I mapped the end-to-end PayPal journey to identify where Chase could add meaningful value within the existing ecosystem. By examining key moments such as card linking and checkout, I identified friction points and opportunities, guiding targeted design improvements that strengthened Chase’s presence within PayPal’s flow.

Design Requirements

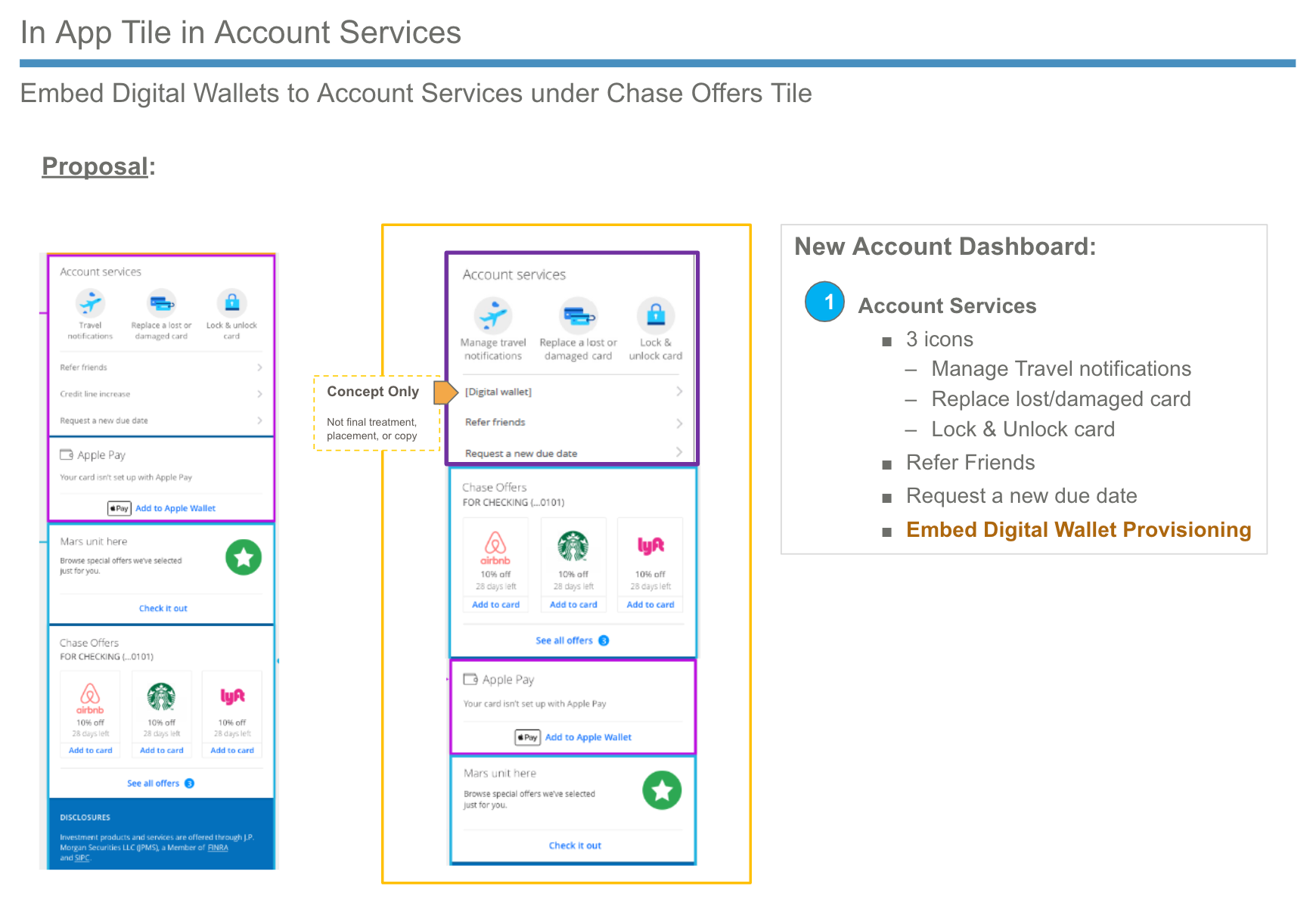

I defined and aligned on core design requirements with product and engineering to ensure a clear, trusted, and efficient experience across both Chase and PayPal. By supporting card linking from either entry point, providing clear feedback, and handling edge cases gracefully, we delivered a consistent experience that reduced friction and reinforced confidence across both ecosystems.

Flexible Entry Points - Allow customers to link Chase cards from either the Chase or PayPal experience without losing context or momentum.

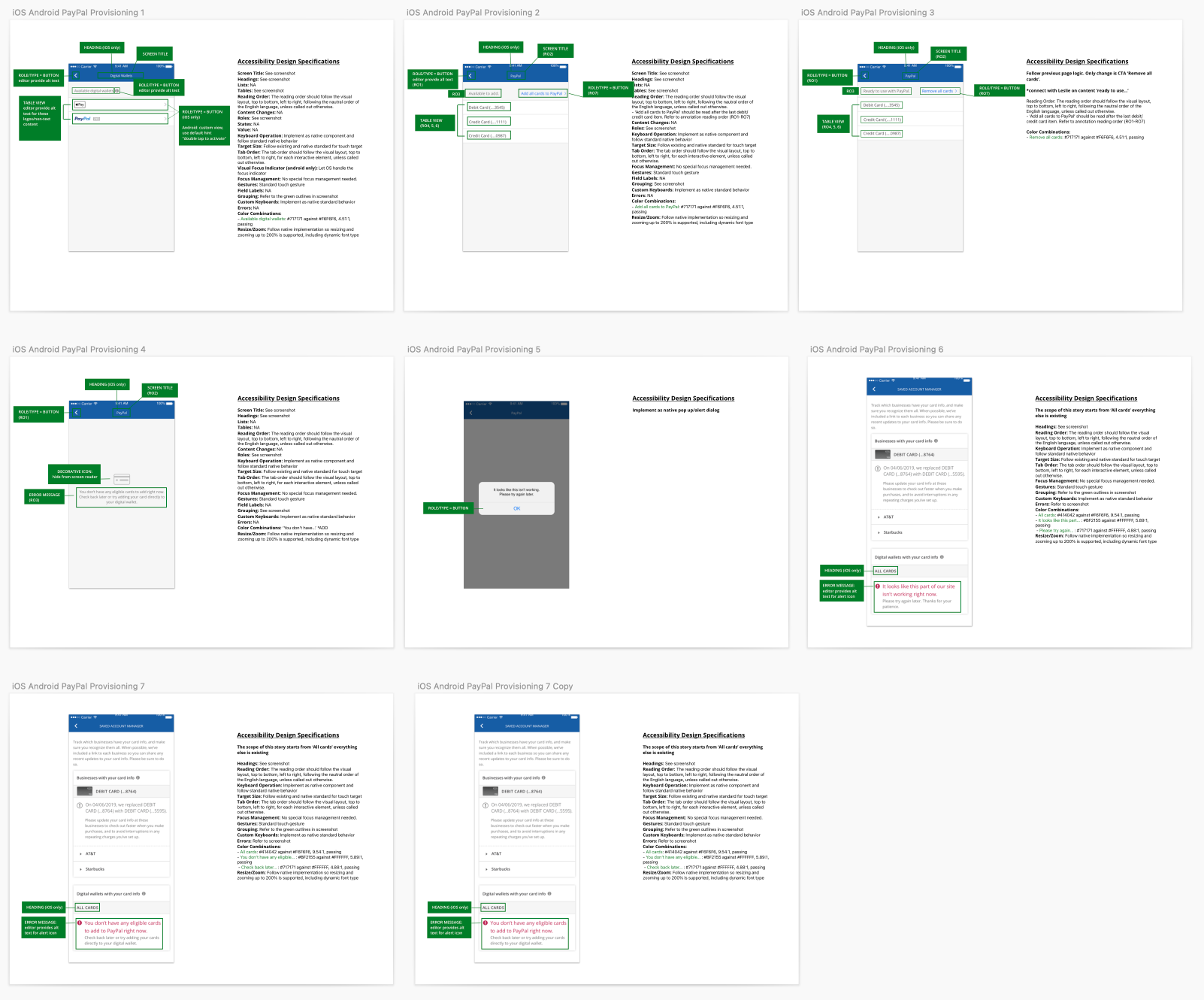

Clarity and Trust - Provide clear feedback, security cues, and guidance at every step to ensure users feel confident throughout the flow.

Designing Beyond Happy Path - Account for real-world scenarios by thoughtfully handling errors, exceptions, and recovery moments.

Reward Transparency - Clearly display reward points and their cash equivalents for eligible cards to help users confidently choose the card that offers the greatest benefit when linking to PayPal.

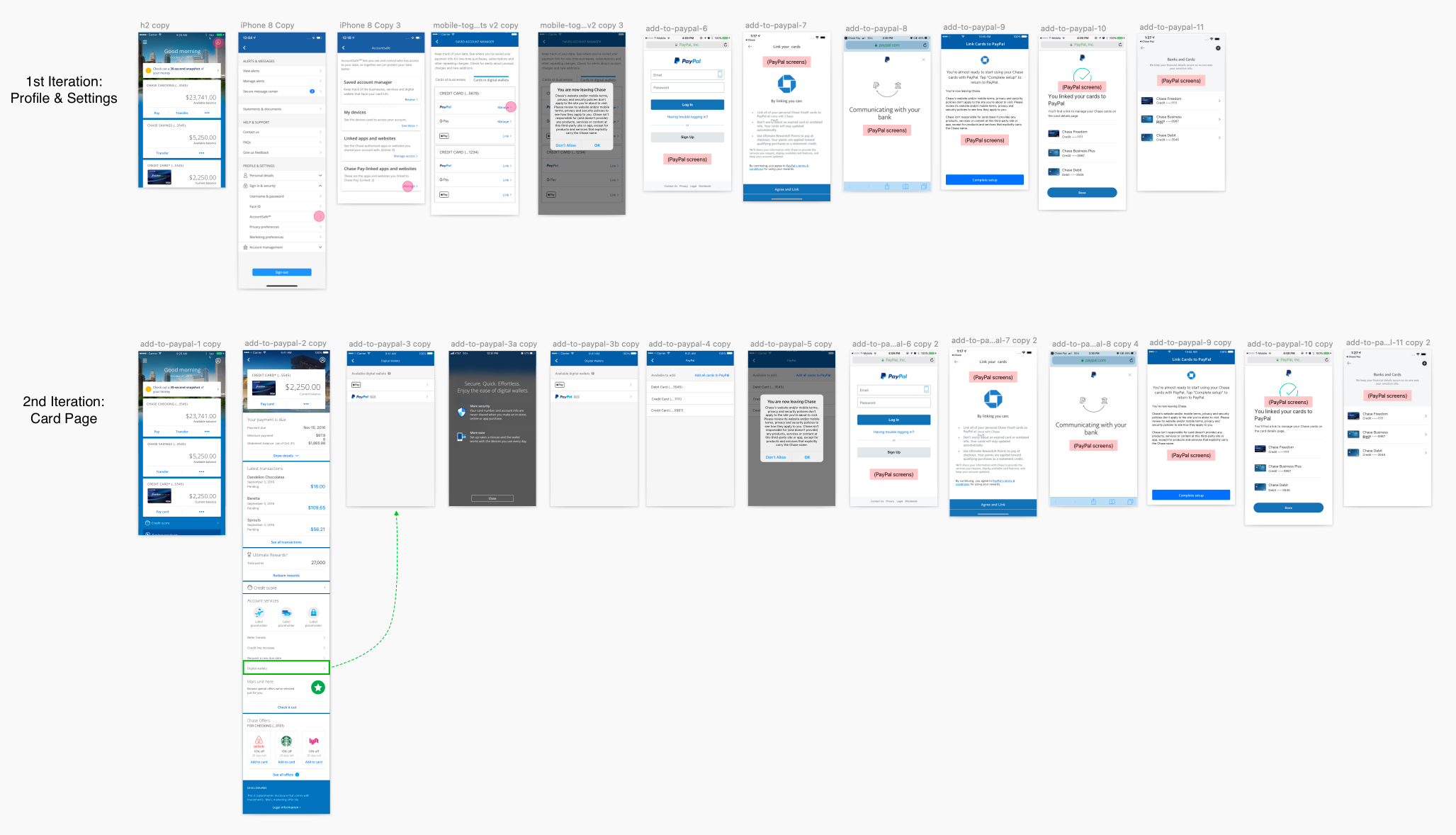

Design Explorations

User Validation

After iterating on early concepts through stakeholder reviews, I partnered with the research team to create a focused validation plan. We recruited 12 participants to test the end-to-end experience across both Chase and PayPal entry points, covering the primary card-linking flow as well as key error and recovery scenarios. Testing confirmed that users could successfully add their Chase cards to PayPal and remove them when needed, with the majority completing both tasks without assistance and reporting high confidence in what was happening and what to do next.

10/12

User successfully located and completed the card-linking flow using the updated digital wallet entry point

9/12

Users noted that the layout and copy made each step feel more straightforward and secure

8/12

Users found it highly valuable to see reward points and cash equivalents displayed beneath each eligible card, helping them quickly choose the card that offered the greatest benefit when linking to PayPal

Final Designs

As the project approached handoff, I partnered closely with cross-functional teams to ensure the final designs were fully aligned, met the accessibility standards, and were ready for implementation. Throughout the iteration, I regularly shared updates with the PayPal design team to keep them informed of proposed changes and validate that our refinements aligned across both ecosystems. Every detail was reviewed to maintain accuracy, consistency, and compliance across Chase and PayPal platforms.

Launch and Impact (Q4 2018)

The Chase Pay and PayPal integration launched in Q4 2018, extending Chase’s reach to over 200 million active users and strengthening its position in the growing digital commerce market. Early adoption metrics and behavioral insights showed strong user response to the simplified card-linking experience and the ability to redeem rewards directly at checkout, reinforcing Chase’s presence as a preferred payment option within PayPal’s ecosystem.

68%

Users who linked their Chase Pay accounts completed transactions more frequently within PayPal, signaling higher engagement and cross-platform usage

+45%

Increase in Chase card transactions processed through PayPal per month, reflecting strong adoption of the integrated linking and payment experience

72%

Of the surveyed users, those who expressed greater confidence in using Chase cards on PayPal cited tokenized security as a key trust factor